.jpg)

Overview

accounting processes and ensure accurate record-keeping. Some common features of back office accounting software for the financial industry may include:

Key Features of AccountSoft

- Online Time Tracking

Specifications

| How is the Software Accessible : On Premises |

| Does this the Software Offers Free trial : Yes |

| Does this Software has a life time free plan : No |

| Does the software run on mobile browser : No |

| Is customisation possible updated: No |

| Are APIs available for this software : No |

| Desktop Platform option : Windows, |

| Mobile Platform Option : Android / Play Store, |

| Language in which the software available :English |

| Integrations : |

Alternative of AccountSoft

AccountSoft Video

AccountSoft USERS

Business

Available Support

Description

That sounds like an interesting software solution! Back office accounting software plays a crucial role in managing the financial operations of brokers, sub-brokers, and investors who are involved in trading shares, derivatives, and commodities on exchanges like BSE, NSE, MCX, NCDEX, and others. Such software typically provides a range of features and functionalities to streamline accounting processes and ensure accurate record-keeping. Some common features of back office accounting software for the financial industry may include:

-

Trade and Transaction Management: The software allows users to record and manage trades and transactions, including buying, selling, and transferring of shares, derivatives, and commodities.

-

Portfolio Management: It enables users to track and manage their investment portfolios, including real-time valuations, performance analysis, and reporting.

-

Settlement and Clearing: The software facilitates settlement processes, including matching trades, calculating net obligations, generating invoices, and managing payment and settlement cycles.

-

Compliance and Regulatory Reporting: It assists users in complying with relevant regulations and generating accurate reports for regulatory bodies, such as SEBI (Securities and Exchange Board of India).

-

Accounting and Financial Reporting: The software provides accounting functionalities like general ledger management, cash flow management, revenue recognition, expense tracking, and financial statement generation.

-

Risk Management: It helps users monitor and manage various types of risks associated with trading, such as market risk, credit risk, and operational risk.

-

Integration with Exchange Systems: The software may offer integration capabilities with exchange systems like BSE, NSE, MCX, NCDEX, and other trading platforms for real-time data feeds, order routing, and trade execution.

-

Client Management: It allows brokers and sub-brokers to manage their client relationships, including client onboarding, account opening, client communications, and reporting.

-

Audit Trail and Security: The software maintains an audit trail of all activities and transactions for compliance and security purposes, ensuring data integrity and confidentiality.

-

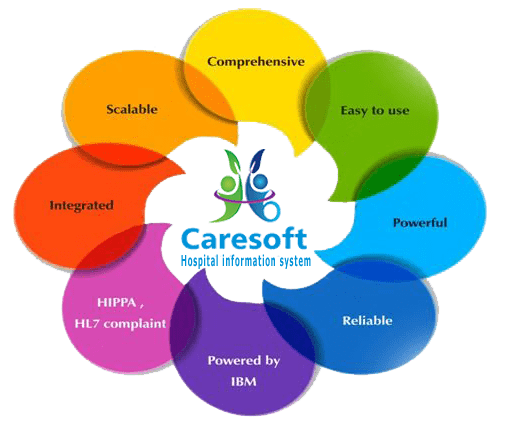

Scalability and Customizability: Back office accounting software should be scalable to accommodate growing business needs and customizable to adapt to specific requirements and workflows.

These are just some of the common features found in back office accounting software for brokers, sub-brokers, and investors in the financial industry. The specific features and functionalities may vary based on the software provider and the needs of the users.

FAQ